The U.S. critical-minerals landscape is being rebuilt in real time, and insiders are voting with their wallets... not their words.

Federal capital, accelerated permitting, and resource-security mandates are reshaping which companies win and which get left behind.

If you’re not tracking where Washington’s weight is landing, you’re missing the most powerful edge in the entire sector.

THREE KEY DEVELOPMENTS

Washington Turns Into the Quietest (and Most Powerful) Investor in the Sector

Washington has stopped pretending it can secure critical minerals with policy memos.

It’s buying equity instead.

At the American Growth Summit, Jarrod Agen, the head of the National Energy Dominance Council, spelt it out:

Taking stakes in critical minerals companies is now the norm, not the exception. And judging by the queue of firms approaching the government, everyone sees where the momentum is shifting.

The logic is straightforward.

China controls most rare-earth mining and nearly all processing, and the last trade-war flare-up proved how fragile that dependence is.

Minerals like gallium, cobalt, and rare earths are used in semiconductors, medical equipment, magnets, jets, and the hardware that runs AI.

Washington wants more of that supply anchored at home, not at the mercy of export restrictions.

So the US is writing checks.

More than $1 billion has already been invested in equity deals — from a 15% stake in MP Materials to major stakes in Vulcan Elements, Trilogy Metals, and Lithium Americas.

Additional talks are underway, and copper and metallurgical coal have now been added to the critical minerals list.

Even allies are being pulled closer, with new joint mining plans and supply-chain negotiations on deck.

Investor takeaway: Follow the companies that earn federal capital, federal contracts, or federal alignment.

That support doesn’t just shift perception; it reshapes competitive advantage.

Deep-Sea Mining Goes From “Future Concept” to “Immediate U.S. Policy Priority”

President Trump just signed an executive order that puts deep-sea mining squarely on the fast track.

You’re looking at one of the biggest policy jolts the critical minerals world has seen in years.

The move aims to boost access to nickel, copper, manganese, and other minerals locked inside polymetallic nodules sitting across the Pacific and in U.S. waters... an area estimated to hold more than a billion metric tons of material the modern economy can’t function without.

Speed up permitting, open both domestic and international waters to accelerated review, and position the U.S. to challenge China’s grip on the critical minerals supply chain.

The numbers are big enough to command your attention... administration officials say commercial extraction could add $300 billion to U.S. GDP and create roughly 100,000 jobs over a decade.

Companies are already lining up. Impossible Metals wants access to American Samoa, and The Metals Company surged nearly 40% after the order hit the wires.

Others from California to Kiribati are preparing bids now that the regulatory lights are turning green.

The order also signals a broader shift for you.

Washington is actively clearing paths for mineral supply that previously sat out of reach.

Investor takeaway: Keep an eye on deep-sea exposure. When policy accelerates access, and companies move quickly, you’re staring at a new pipeline of opportunity rather than a long-shot concept.

This Copper Run Is Structural, Durable, and Now Impossible to Ignore

Copper just smashed another all-time high... and if you’re watching mining stocks, this is a development you’ll want to keep on your radar.

Prices surged past $11,700 a ton after China doubled down on making domestic growth its top priority for next year.

Beijing’s commitment to a proactive fiscal stance and moderately loose monetary policy has injected fresh optimism into the market, and copper is soaking up the attention.

China’s latest trade data added even more fuel, with exports rebounding and the country’s trade surplus topping $1 trillion for the first time.

Pair that with rising demand from data centers, EVs, and massive power-grid upgrades, and you have a market moving with real purpose.

Copper is already up more than 30% on the LME this year, and supply remains tight thanks to mine outages and smelters outpacing raw material availability.

Meanwhile, the US is stockpiling copper ahead of potential tariffs under President Trump... squeezing global inventories and sending premiums soaring.

Analysts now see a 450,000-ton supply shortfall by 2026, and prices may need to average above $12,000 next year just to encourage new mining investment.

Investor takeaway: Copper’s momentum isn’t just hype. It’s grounded in structural demand, policy support, and real supply pressure.

If you’re tracking mining names, this is the kind of backdrop that can reshape valuations.

TODAY’S TRIVIA

MINING STOCKS TO CHECK OUT

A Miner That’s Heating Up While the Market Cools Off

If you’ve been watching the energy space drift, this is the name that should make you sit up a little straighter.

Peabody Energy (NYSE: BTU) has been quietly tightening its operations—streamlining costs, sharpening execution, and proving it can run lean without cutting corners.

That discipline is feeding directly into stronger cash flow, which is exactly what you want to see before the market wakes up to the story.

While everyone else hunts for momentum in noisy corners of the market, you’re looking at a company whose fundamentals are stacking up faster than its valuation admits.

And that gap? That’s where your opportunity sits.

BTU’s momentum isn’t luck. It’s a combination of valuation support, operational strength, and a market finally giving the company credit for both.

If you want a stock that rewards patience and operational discipline, this miner is giving you all the signals.

A Silver Stock That Keeps Golden Potential on Deck

If you want a metals name with catalysts you can actually track, Coeur Mining (NYSE: CDE) gives you something tangible to work with.

The company has been expanding its asset base, pushing key projects toward higher output, and improving the balance sheet enough to support that next leg of growth.

These aren’t theoretical tailwinds... you’re watching a business build the production profile it’s been signaling for years.

Add to that a valuation that still reflects yesterday’s challenges rather than today’s operational footing, and you end up with a stock that’s giving you more than the market’s giving it credit for.

As those production gains come online, sentiment tends to shift fast in names like this.

If you want leverage to a growing silver-and-gold story backed by real operational catalysts, Coeur gives you something concrete to position around.

Steel Demand Is Hot, and This Producer Is a Market Standout

If you want a company where the fundamentals speak louder than the headlines, Alpha Metallurgical Resources (NYSE: AMR) fits the bill.

The business has been running with tight cost control, disciplined capital allocation, and a production mix aligned with steel demand that hasn’t softened the way many expected.

When you combine that with a balance sheet built for down cycles, you get a name that can compound strength while others stall.

Ignore the small sales; that massive insider buy is the only signal you need.

When a director puts their own cash on the line, they're showing you absolute confidence in this US-based met coal supplier.

You have strong technical support and overwhelming conviction from the person who knows the books best. Follow the smart money.

METALS SNAPSHOT

Copper: Record-breaking rally driven by global supply deficits, U.S. stockpiling, and surging demand from AI data centers and grid expansion.

Nickel: Deep-sea mining fast-tracked; U.S. permitting acceleration boosts domestic and ocean-floor exploration interest.

Uranium: Strong policy backing as nuclear rises as a national-security priority; exploration funding and utilities restocking fuel momentum.

Rare Earths: Federal equity stakes and strategic investments shift attention toward U.S.-aligned producers and processing partners.

Gallium & Germanium: Renewed China export-control pressures revive U.S. urgency to secure alternative supply and domestic refining.

Silver: Industrial demand (solar, chips, electronics) tightening supply outlook; critical designation amplifies investor focus.

Gold: Stable safe-haven bid; investors rotate defensively while waiting for clearer macro and rate signals.

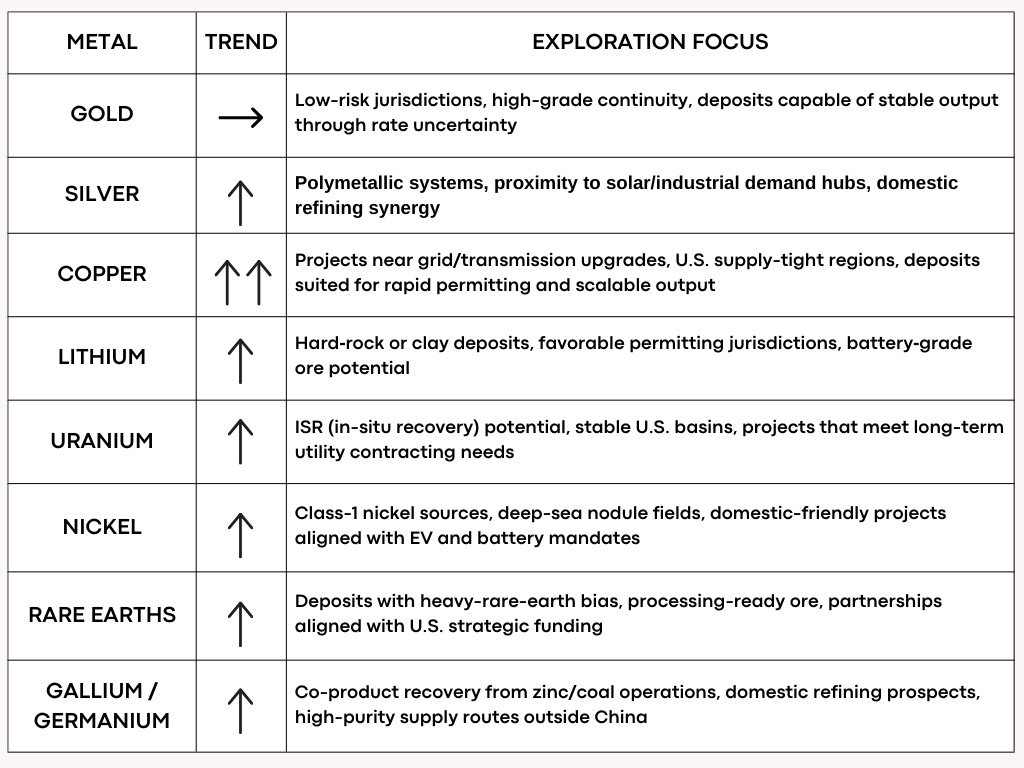

Metal Trend Exploration Focus

With insider money flowing in and structural demand tightening across copper, rare earths, and met coal, you’re watching a sector where conviction and policy are finally pointing in the same direction.

If you want exposure to the next decade’s resource winners, this is the moment to look past the headlines and start paying attention to where the real capital is moving.