The race for resource independence has officially gone underwater, and the market is starting to connect the dots.

What was once dismissed as science fiction is rapidly becoming a strategic shortcut for securing the metals that power AI, defense, and electrification.

That shift is exactly where you start spotting the edge before it shows up in price.

THREE KEY DEVELOPMENTS NOT TO IGNORE

Greenland Is Heating Up Fast As Critical Minerals Rewrite Power Maps

You’ve likely heard the "buzz" lately, and no, it isn't just the Arctic wind.

With the White House actively eyeing a takeover of Greenland, the world’s largest island has suddenly become the hottest ticket in mining.

If you’re looking for where the smart money is moving, you’ll want to watch the players already on the ground.

Take Critical Metals Corp, for instance. Their stock has already skyrocketed 116% since the start of 2026.

Why? Because they are sitting on a potential goldmine of heavy rare earth elements (HREE).

These aren't just rocks; they are the lifeblood of everything you use, from the EV in your driveway to the AI data centers powering the future.

Tech giants are already sniffing around because, let’s face it, you can’t build a "Magnificent Seven" empire without the minerals to back it up.

Then there’s Amaroq, which recently flagged "commercial levels" of germanium and gallium.

These are the exact minerals China throttled last year.

By positioning yourself here, you aren't just betting on a territory; you’re betting on a strategic shift in global power.

Your takeaway: While the geopolitics might feel like a movie plot, the opportunity for you is very real.

Greenland is transitioning from a frozen frontier to a critical mineral powerhouse, and the early birds are already reaping the rewards.

The Ocean Floor Is Calling, And Strategic Metals Are Answering Back

If you thought the only way to find critical minerals was by digging giant holes in the ground, think again.

The Metals Company (TMC) is looking toward the ocean floor, and the market is officially waking up to the potential.

After a rocky end to 2025, you’ve likely noticed TMC shares staging a massive comeback, surging nearly 70% from their recent lows.

Why the sudden rush? It’s all about security.

You know the drill: the U.S. is tired of relying on outside sources for the nickel and cobalt needed for high-tech batteries and AI infrastructure.

TMC is taking a bold shortcut by working directly with U.S. authorities, such as NOAA, rather than waiting on international red tape.

This move is positioning them as a domestic heavyweight in the making.

Yes, there’s still plenty of talk about regulations and environmental checks, but the momentum is undeniable.

With short interest fueling explosive price swings and Washington hunting for strategic wins, TMC is firmly back on the radar.

You are watching a high-stakes play for the very materials that will power the next decade of innovation.

Your takeaway: The tide is turning for deep-sea mining.

As the U.S. pushes for mineral independence, TMC is perfectly placed to benefit from the shifting geopolitical landscape.

Domestic Rare Earth Supply Is Accelerating Faster Than Anyone Expected

If you saw the USA Rare Earth (USAR) dip in December, you might have been tempted to look away... but you would have missed a massive 48% surge to kick off 2026.

While some were busy booking profits, the company was quietly shifting into high gear, proving that the future of American tech and defense isn't just a talking point; it's a rapidly approaching reality.

The big news? You no longer have to wait until 2030 for the flagship Round Top deposit in Texas to hit its stride.

The company just slashed two years off that timeline, eyeing commercial production by late 2028. This isn't just about digging; it’s about the entire value chain.

By the first quarter of this year, the Stillwater facility in Oklahoma will begin commissioning, putting the "magnet" in their mine-to-magnet strategy.

With strategic acquisitions like the U.K.-based Less Common Metals already under its belt, you are looking at a company that is systematically cutting China out of the equation.

Whether it's the buzz around new mineral corridors in Venezuela or the aggressive reshoring of supply chains, the wind is firmly at USAR's back.

Your takeaway: USA Rare Earth is transitioning from a speculative story to an industrial reality.

With production timelines moving up and domestic manufacturing starting now, you are watching a cornerstone of U.S. resource independence take shape.

TODAY’S POLL

Which feels more satisfying?

MINING STOCKS TO CHECK OUT

Aluminum is Riding the High-Voltage Resurgence

If you’ve been tracking the "made-in-America" comeback, Century Aluminum (NYSE: CENX) is currently front and center.

While the headlines might focus on short-term volatility and institutional options, you should look at the massive fundamental engine firing up underneath.

The real story here is the aggressive move toward U.S. aluminum independence. After years of idling, the Mt. Holly smelter is finally charging back to full capacity.

With the current tariff environment making foreign metal expensive, you are watching Century transform into the preferred vehicle for anyone betting on domestic industrial strength.

Beyond the smelter restarts, the company is securing its future with long-term energy deals through the next decade and exploring a low-emission smelter project backed by government funding.

As aerospace and defense demand for high-purity aluminum reaches a fever pitch, Century is positioned to convert these policy tailwinds into tangible, long-term growth.

The Quiet Giant of Aerospace and Auto

If you’ve been looking for a stock that’s effectively "moving the needle" without the usual mining-sector drama, Constellium (NYSE: CSTM) is a name you can’t ignore.

While some analysts have shifted to a "hold" rating recently, don't let that dampen your enthusiasm.

The reality is that this aluminum powerhouse just hit a new 52-week high, and the momentum is backed by serious operational wins.

You are seeing a company that isn't just digging metal; it's engineering high-value solutions for Embraer’s jets and the next generation of electric vehicles.

With their recycling capacity in France expanding, they are positioning themselves to grab cheaper raw materials while hitting sustainability targets that the big tech and auto players demand.

Even with geopolitical talk about carbon tariffs, the widening scrap spreads are expected to act as a tailwind throughout 2026.

As aerospace and packaging demand stay hot, this is a refined way to play the metals rally.

Minerals Project Is Becoming America’s Strategic Wild Card

If you are hunting for a domestic heavy-hitter in the critical minerals space, NioCorp Developments (NYSE: NB) just signaled it is ready for prime time.

After years of preparation, the company recently received a massive vote of confidence from Wall Street, with analysts initiating coverage and setting targets that suggest the current price is just the beginning.

You are looking at a project in Nebraska that is finally moving from "what if" to "when." The board recently greenlit construction for the mine portal, with work kicking off this quarter.

This isn't just about digging for niobium and titanium; it’s about a vertically integrated supply chain for scandium alloys that the Pentagon is already helping to fund.

With a record cash balance now sitting on the books and heavy-duty backing from federal and state leaders, NioCorp is de-risking at a rapid pace.

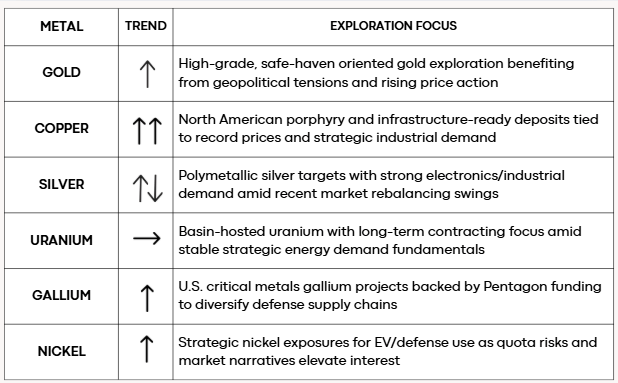

METALS SNAPSHOT

Gold: Gold prices climbed on geopolitical tensions and safe-haven flows, keeping exploration interest high for secure, high-grade assets.

Copper: Copper continues making headlines with record highs on tight supply and strategic demand forecasts, boosting interest in North American porphyries.

Silver: Silver has seen recent volatility with sharp swings after index rebalancing, but strong physical demand narratives persist.

Uranium: Uranium markets remain supported by long-term contracting and stable fundamentals, with little short-term price action but ongoing strategic demand.

Gallium: The Pentagon’s latest $150 M investment in U.S. gallium production marks a breakout U.S. critical metals narrative this week.

Nickel: Nickel is drawing fresh attention as quotas and trading dynamics push prices and strategic narratives, especially in EV and defense sectors.

Metal Trend Exploration Focus

You are witnessing a historic pivot as the industry shifts from simple extraction to a high-stakes race for strategic dominance and domestic self-sufficiency.

By keeping your eyes on these specific developments, you are positioning yourself to ride the wave of a massive industrial reset that is only just beginning..