The global race for resources is no longer just about who can dig the deepest hole in the ground.

We’re now seeing a massive shift toward companies that use intelligence, infrastructure, and lean operations to extract maximum value from every single ton.

Here’s what that means for you and your portfolio.

THREE SHIFTS TURNING MINING INTO A MARGIN GAME

This Mine’s Best Assets Aren’t Even On The Label

You probably think you know what’s in a copper or gold mine: copper and gold.

It turns out, you might be missing the best part of the story.

A groundbreaking study from the Colorado School of Mines just revealed that U.S. metal mines are literally sitting on a fortune of "critical minerals" like cobalt, lithium, and tellurium that are currently being tossed out with the trash.

Here is the kicker: we aren’t just talking about a few scraps. If you recovered just 1% of these overlooked byproducts, you’d see a massive dent in our reliance on foreign imports.

Boost that to 90%, and you’ve essentially solved the domestic supply crisis for almost every critical mineral on the list.

In many cases, the value of these "extras" actually exceeds the value of the primary metal the mine was built for.

Instead of waiting decades for new permits, you are looking at a future where existing operations simply upgrade their tech to stop throwing away the good stuff.

For anyone watching the mining space, this is a massive "aha" moment for domestic security and your bottom line.

Your takeaway: You should keep a close eye on established U.S. miners.

Companies that pivot to byproduct recovery aren't just cleaning up waste; they are unlocking a secondary, high-value revenue stream from ore they’ve already dug up.

The Tech Level-Up: NMDC Hits a New High

If you’ve been looking for a reason to watch NMDC, you just got a big one.

Shares of this mining heavyweight just hit a fresh 52-week high, and the buzz isn't just about what they’re digging up... it’s about how they’re doing it.

The company recently inked a major deal with the Colorado School of Mines to bring AI and machine learning directly into its operations.

This isn't just corporate window dressing. You are seeing a shift toward "smart mining" that uses data to squeeze more value out of every ton of earth moved.

From better mineral processing to extracting critical materials that used to be considered waste, this partnership puts NMDC at the front of the line for efficiency.

Analysts are already flagging a decisive breakout, with technical targets pointing toward more upside for the U.S. mining and AI sector.

This is a state-run giant that is finally acting like a tech-forward innovator.

Your takeaway: You should treat NMDC as a "growth-meets-value" play.

By combining their massive scale with high-end U.S. research, they are positioning themselves to dominate the next era of mineral demand.

The Fastest Supply Fix Was Already Dug Up

You’re watching a logistics breakthrough that feeds directly into how U.S. markets price risk, inflation, and industrial growth.

Liberia’s ratified rail-and-port deal gives Ivanhoe Atlantic guaranteed access from pit to port, turning stranded ultra-high-grade iron ore into exportable supply by 2027.

That timing matters. U.S. markets are shifting from demand-driven narratives to input certainty, and steel sits upstream of nearly every growth theme investors still believe in.

Iron ore averaging ~67.8% Fe lowers energy intensity and coke usage for steelmakers, improving margins just as energy costs and carbon constraints remain volatile.

For U.S. industrials tied to grid upgrades, EV manufacturing, data centers, and defense, a predictable iron ore supply reduces cost shocks and stabilizes forward guidance.

That’s quietly bullish for multiples.

There’s also a macro layer. Western capital is actively repricing supply chains that bypass China-controlled infrastructure.

A multi-user rail system in Liberia increases throughput, caps bottleneck risk, and limits price spikes that would otherwise bleed into U.S. inflation expectations.

Less volatility upstream means less pressure on downstream pricing power.

Your takeaway: Assets that control logistics outperform assets that merely own geology.

This deal reinforces a broader U.S. market tailwind, when raw materials become reliable instead of political, capital rotates back into industrial execution stories.

TODAY’S POLL

Which feels more valuable to you right now?

MINING STOCKS TO CHECK OUT

This Lithium Giant Found Its Balance Again

You’ve likely heard about the "lithium winter," but Albemarle Corporation (NYSE: ALB) just proved that spring has officially arrived.

After a brutal stretch of price volatility, this Charlotte-based heavyweight spent the year reinventing itself as a leaner, meaner efficiency machine.

Instead of just chasing growth, they have successfully pivoted to a value-first model that prioritizes healthy margins over raw volume.

The turnaround is already showing up on the tape.

You are looking at a company that surpassed its own aggressive cost-cutting targets while simultaneously ramping up world-class facilities like the Meishan plant in China.

Even better, they have secured a massive domestic advantage with the Kings Mountain mine in North Carolina being fast-tracked as a project of national significance.

By locking in long-term deals with giants like Ford, Albemarle is essentially building a fortress around its future cash flows.

Trimming the Fat to Feed the World

You’ve likely seen The Mosaic Company (NYSE: MOS) in the headlines for its massive global footprint, but its latest move is all about getting lean.

Just days ago, Mosaic announced a deal to sell its Carlsbad potash operations for a cool $30 million.

While a divestiture might sound like a retreat, you should see this as a surgical strike for efficiency.

By offloading these assets, Mosaic is doubling down on its high-return mines in Saskatchewan, Canada.

Even better, this move comes right as the U.S. officially added potash and phosphate to its Critical Minerals List.

This isn't just a win for agriculture; it’s a national security play that could unlock streamlined permitting and federal support.

You should watch Mosaic as it consolidates its power.

By focusing on its most profitable Canadian assets and riding the new "critical" status of its core products, the company is positioning itself for a major structural recovery.

This Ag Leader Took Heat And Kept Executing

You are seeing a classic "buy the dip" setup as Corteva, Inc. (NYSE: CTVA) navigates a bit of turbulence from Washington.

The stock recently cooled off after the government announced a probe into crop inputs, but you should look past the headlines.

This isn't a fundamental breakdown; it is a temporary reset for a company that remains the dominant powerhouse in agricultural science.

While the regulators take their "hard look," Corteva is busy executing a massive strategic shift.

They are currently on track to split into two specialized leaders: "New Corteva," focused on crop protection, and "SpinCo," dedicated to high-margin seed genetics and gene editing.

This move is designed to unlock hidden value and protect the high-growth seed business from broader regulatory noise.

With double-digit gains in operating EBITDA and a massive pipeline of hundreds of new hybrid products launching soon, the underlying engine is firing on all cylinders.

You should focus on Corteva’s resilience and its upcoming separation.

Historically, focused spin-offs create significant alpha, and with Corteva's ironclad balance sheet and leadership in AI-driven genetics, this temporary regulatory cloud is likely just an entry window.

METALS SNAPSHOT

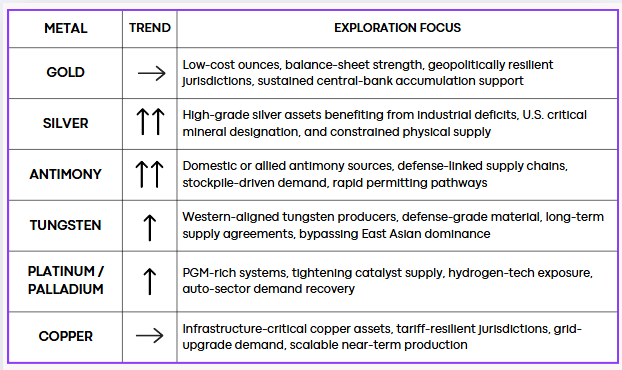

Silver: The standout performer of late 2025, shattering historic resistance levels as industrial supply deficits collide with its new U.S. critical mineral status.

Gold: Maintaining a high-floor regime despite year-end profit-taking, as geopolitical instability and central bank hoarding anchor its long-term value.

Antimony: Making massive headlines following China’s export restrictions and the U.S. government’s urgent push to secure domestic military stockpiles.

Tungsten: Surging in strategic importance as the U.S. formalizes new supply deals with Western-aligned producers to bypass East Asian dominance.

Platinum & Palladium: Seeing a resurgent late-year rally driven by tightening supply in catalytic converter markets and renewed hydrogen-tech interest.

Copper: Consolidating near multi-year highs as traders weigh upcoming 2026 tariff policies against the relentless global demand for energy grid upgrades.

Metal Trend Exploration Focus

Closing Lens

The era of "dig and ship" is officially over, and the edge now belongs to the operators who treat their assets like high-tech factories.

You should stay focused on the players securing their own logistics and mastering byproduct recovery, because these are the firms quietly building a moat while everyone else just watches the spot prices.