The mining sector has a problem that drills can’t fix. Fatigue is becoming a billion-dollar liability, and AI is the only solution.

One company is positioning itself as the industry’s built-in guardian angel.

THREE KEY DEVELOPMENTS

The Biggest Mining Reversal Of The Decade

If you’ve been looking for a seismic shift in the global resource landscape, the recent U.S. takeover of Venezuela is the headline of the decade.

This is a full-scale reclamation of one of the world's most mineral-rich jurisdictions. The White House is moving with "American dominance" in mind, specifically targeting the "rusty" mining infrastructure that has been sitting atop massive deposits of gold, nickel, and bauxite for years.

The strategic goal here is clear: boot out the competition and secure the supply chain.

While China has had discreet access to these minerals for far too long, the new "Don-roe Doctrine" ensures that U.S. and allied capital will be the primary force rebuilding the Orinoco Mining Arc.

You are looking at a scenario where the geopolitical risk is being managed directly by Washington, transforming a once-volatile region into a protected asset class.

From rare earth elements to high-grade iron ore, the sheer scale of the resources being unlocked is too significant to ignore.

Your takeaway: The U.S. intervention has turned Venezuela from a "no-go zone" into a strategic priority. As the administration rolls out incentives for firms to "fix and bring back" the mining sector, you have a front-row seat to the most aggressive resource play in modern history.

The Metal Powering The AI Arms Race

If you’ve been watching artificial intelligence through chips and software alone, you’re missing the real constraint.

AI doesn’t run on code.

It runs on electricity, and electricity runs on copper.

S&P Global’s latest analysis makes it blunt: global copper demand is set to surge 50% by 2040, driven by electrification, data centers, defense systems, and grid expansion. This is a structural reset where copper becomes the physical backbone of the digital economy.

The fastest-growing driver wasn’t even visible four years ago.

The problem is supply isn’t keeping up.

Copper has now been formally designated a critical mineral by the United States, putting it in the same strategic category as materials tied directly to national security. Substitutes exist on paper, but in practice, copper’s conductivity, durability, and safety profile make replacement extremely limited.

You’re looking at a scenario where copper shifts from an enabler to a gatekeeper.

Every megawatt of power added, every data center built, every electric vehicle sold, every modern weapon system deployed depends on it. And the supply chain behind that metal is far more fragile than the market currently prices.

Your takeaway: Copper is no longer just an industrial input; it’s a strategic choke point. As AI, electrification, and defense spending accelerate simultaneously, metal is becoming the limiting factor.

Safety is the New Gold: Why Fatigue Tech is the $3 Billion Sector to Watch

If you’ve been focusing solely on the minerals in the ground, you might be missing the high-tech shield protecting the people who pull them out.

The mining fatigue monitoring market is officially on fire, projected to double from $1.6 billion this year to a massive $3.1 billion by 2033. For you, this isn’t just about safety; it’s about a 10.2% compound annual growth rate in a sector that is becoming a mandatory "license to operate" for global giants.

Mining is a high-stakes, 24/7 game where a single tired operator can cause millions in damage.

To solve this, companies are flooding the market with AI-powered wearables, smart helmets, and eye-tracking cameras that spot a "microsleep" before it happens.

North America currently leads the charge with strict regulations, but the real explosion is coming from Asia-Pacific, where rapid expansion is making these safety systems a strategic necessity.

Your takeaway: Safety technology is no longer a niche expense; it’s a booming growth sector. As mines move toward full automation and zero-harm targets, the firms providing these AI "guardian angels" are becoming indispensable pieces of the global mining ecosystem.

TODAY’S TRIVIA

Poll: What’s harder to stick to?

MINING STOCKS TO CHECK OUT

The Rare Earth Giant in Your Backyard

If you’re hunting for a mining play that combines the stability of gold with the explosive potential of national security tech, Idaho Strategic Resources (NYSE American: IDR) is showing up in a big way. While most junior miners are still stuck in the "hopeful" phase, you are looking at a producer that is already pulling high-grade gold from its flagship Golden Chest Mine.

The market clearly noticed, with shares jumping over eleven percent in a single day as the company crushed earnings expectations and maintained a nearly debt-free balance sheet.

Beyond the gold, you have a stake in the largest rare earth land package in the United States.

With the federal government pushing for domestic mineral independence, $IDR is sitting on critical thorium and rare earth projects that the military and energy sectors are desperate for.

The company is vertically integrated—they explore, drill, and mill their own ore—which means they keep the profits that other companies pay out to contractors.

The High-Tech Heart of the Lithium Belt

If you have been scrolling through your feed lately, you probably noticed Standard Lithium (NYSE American: SLI) is suddenly everywhere.

While the internet is busy debating whether this is just another hype cycle, you should focus on the massive strategic shift happening in the Arkansas Smackover formation. Unlike traditional miners that rely on massive evaporation ponds, this company is deploying Direct Lithium Extraction (DLE) technology to pull battery-grade material straight from brine in a matter of hours.

With a massive grant from the Department of Energy already in the bag and a powerhouse partnership with Equinor, the company is moving toward commercial production with the kind of institutional backing most juniors only dream of.

You have a rare chance to grab a seat at the table with a company that has the funding, the tech, and the government support to lead the domestic lithium race.

The Gatekeeper of the American Grid

Centrus Energy (NYSE: LEU) just kicked off the year with a massive double-digit jump, proving that the market is finally waking up to its role as a strategic powerhouse.

You are looking at the only company on American soil currently building the specialized centrifuges required to produce the advanced fuel for next-generation reactors.

With a federal ban on Russian fuel imports looming and a multibillion-dollar backlog of contracts already on the books, Centrus is effectively becoming a sovereign-backed monopoly for domestic energy security.

The company is scaling up its Ohio facility to meet an insatiable demand from utilities that are desperate for a secure, non-foreign supply chain.

You are getting exposure to a high-momentum play that sits right at the intersection of big tech’s power needs and national defense.

METALS SNAPSHOT

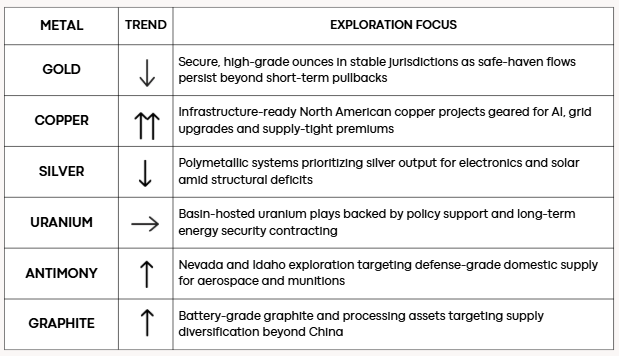

Gold: High-grade exploration is surging in Nevada and Alaska as the reset in Venezuela triggers a massive safe-haven rotation. You are seeing a strategic shift to secure jurisdictions to replace global reserves.

Copper: Supply scarcity has pushed the red metal into uncharted territory. Investor interest is centering on North American projects with established infrastructure to meet the relentless demand from the AI boom.

Silver: Deficits are at a breaking point, with silver outperforming gold. You are witnessing a race toward polymetallic discoveries to feed the insatiable electronics and solar sectors.

Uranium: Billions in federal support for domestic enrichment are providing a rock-solid floor for explorers. The focus remains on basin-hosted projects that promise long-term energy security for the U.S. grid.

Graphite: This battery staple is now a national security priority. Junior miners are scaling up with direct Pentagon backing to break foreign monopolies and localize the defense supply chain.

Antimony: The "war metal" is the week’s breakout story. Following a massive Pentagon commitment to the national stockpile, exploration is being fast-tracked to ensure a domestic source for munitions.

Closing thoughts…

As you navigate this high-stakes landscape, remember that the most successful moves in 2026 aren't just about spotting the best dirt; they are about understanding the new rules of global engagement.

Whether you are tracking a junior miner in Idaho or a tech-driven lithium play in Arkansas, the common thread is a world that values security and speed over old-school patience.