The traditional rules of the mining game are being rewritten as government equity stakes and high-tech domestic processing take center stage.

You are currently witnessing a rare alignment where national security needs and aggressive exploration results are creating a very profitable path forward for those paying attention.

THREE KEY DEVELOPMENTS

Watch This Reset Turn Into A Rebuild

US1 Critical Minerals (ASX: USC) is making some high-stakes moves that you should definitely have on your radar.

The company is currently pivoting from its legacy as Gladiator Resources into a streamlined, tech-focused critical minerals powerhouse with a serious appetite for growth.

You are seeing a massive show of confidence through a new placement that brings in strategic backing from Nasdaq-listed Snow Lake Energy.

This capital injection isn't just for keeping the lights on; it is specifically earmarked to accelerate their rare earth projects in the US and Tanzania.

To lead this charge, they’ve appointed Avi Geller, a US capital markets veteran, to the board to steer their North American strategy and navigate current legal maneuvers over California tenements.

While legal battles are usually a headache, you have to appreciate the resolve here: the company is aggressively pursuing its rights to high-value rare earth assets to ensure they don't leave any value on the table.

With the US pushing harder than ever for domestic mineral security, US1 is positioning itself exactly where the global supply chain is most hungry for results.

Your takeaway: With a fresh $1.5 million in the tank and new leadership from the US markets, US1 Critical Minerals is aggressively clearing hurdles to unlock a major rare earth future.

This Is What De-Risking A Country Looks Like

Peru is currently providing the US a masterclass in why formalization matters for your bottom line.

This is a decisive moment where the government and industry leaders are moving to protect $12 billion in formal mining investments from the reach of illegal operations.

While high commodity prices have drawn unwanted attention to major concessions, the narrative is shifting toward a much-needed structural cleanup.

You should view this as a major cleaning of the house that secures the future of global mineral supply.

The push for the new MAPE Law is designed to replace temporary fixes with a permanent, traceable framework that brings small-scale miners into the light.

For giants like Newmont and Southern Copper, this movement is about reclaiming the narrative and ensuring that the $22.8 billion previously lost to suspicious transactions starts flowing back into the formal economy.

This is a country that is finally treating its mineral wealth like the strategic national infrastructure it is, ensuring that the next decade of production is safe, legal, and highly profitable.

Your takeaway: Peru’s aggressive shift toward formalization is a massive de-risking event that protects $12 billion in projects and solidifies its status as a top-tier mineral supplier.

When The State Becomes A Shareholder

If you thought the government only cared about regulating your favorite stocks, you haven't seen the latest cap tables.

In a move that is turning the traditional free-market playbook on its head, the Trump administration is aggressively buying its way into the mining and metals sector.

You are no longer just betting on a company’s geological luck; you are betting on businesses that have the full financial and strategic weight of the U.S. government behind them.

From the Pentagon taking a fifteen percent stake in MP Materials (NYSE: MP) to the Department of Energy restructuring massive debts for Lithium Americas (NYSE: LAC), the feds are making it clear that critical minerals are the new national security frontier.

This isn't just about Intel or chips anymore.

You are looking at a $10 billion investment wave that includes rare earth startups like Vulcan Elements and explorers like Trilogy Metals (NYSE: TMQ).

For you, this means these companies now have a "price floor" backed by federal policy and a seat at the table that competitors can't touch.

When the government becomes the largest shareholder, "business as usual" transforms into a mission-critical operation with an almost guaranteed domestic offtake.

Your takeaway: Massive federal equity stakes in critical mineral companies are de-risking the sector and turning these miners into protected national assets with unparalleled capital backing.

TODAY’S POLL

You see “Only 3 left in stock.” Your reaction?

MINING STOCKS TO CHECK OUT

This Milestone Changes The Domestic Supply Story

If you have been tracking the race for a domestic critical mineral supply chain, Energy Fuels (NYSE American: UUUU) just crossed the finish line in a way that should make you sit up.

While most explorers are still stuck in the "feasibility study" phase, this company just proved it can produce 99.9% pure dysprosium oxide right here in the U.S. and, more importantly, passed the rigorous quality audits of a major South Korean automotive giant.

By qualifying its "heavy" rare earth oxides for high-performance magnets, Energy Fuels has become the first domestic player to unlock the full light-and-heavy spectrum required for EVs and defense systems.

This isn't just about chemistry; it’s about a strategic monopoly on the only operating conventional uranium mill in the country, repurposed into a rare earth powerhouse.

With terbium and samarium pilots already in the pipeline and a commercial scale-up targeted for late 2026, the company is effectively de-risking its future while Chinese export controls tighten.

These Drill Results Don’t Respect Old Boundaries

If you’ve been tracking the revival of South Dakota’s legendary mining districts, Dakota Gold (NYSE American: DC) just gave you a very compelling reason to lean in.

The company just wrapped up a massive drilling campaign at its Richmond Hill Project, and the results are effectively redrawing the map.

They aren’t just finding gold where they expected; they are intersecting high-grade mineralization far beyond the known boundaries, proving this project is much larger than previously thought.

You are looking at a classic "expansion" story.

By hitting significant gold grades hundreds of meters north of their current resource, the team is unlocking massive potential for a longer mine life and higher production.

This isn't just speculation, as they’ve completed hundreds of holes this year to feed into a looming Feasibility Study.

With nearly half of their assay results still pending, you are essentially watching a high-stakes reveal that continues to favor the bulls.

As they move toward commercial production by 2029, Dakota Gold is transforming a historic legacy into a modern, high-grade powerhouse.

This Miner Is About To Change Its Weight Class

If you’ve been hunting for a miner that is actually delivering on its growth promises, Eldorado Gold (NYSE: EGO) is putting on a clinic.

While some stocks stumble at the finish line, Eldorado just hit a fresh 52-week high, and for good reason.

You aren’t just looking at a company riding the coattails of record gold prices; you’re looking at an operator that is about to fundamentally change its DNA.

The big story here is the Skouries project in Greece. It’s over 70% complete and on track for its first production in early 2026.

This isn't just another mine; it’s a massive copper-gold powerhouse that will diversify the company’s revenue and send its annual production climbing toward 700,000 ounces.

Even better, you are seeing their reserves grow, with a 25% jump at the Lamaque Complex in Canada proving that their exploration team is firing on all cylinders.

With low leverage and a solid balance sheet, Eldorado is proving that hitting all-time highs is just the beginning of its next chapter.

METALS SNAPSHOT

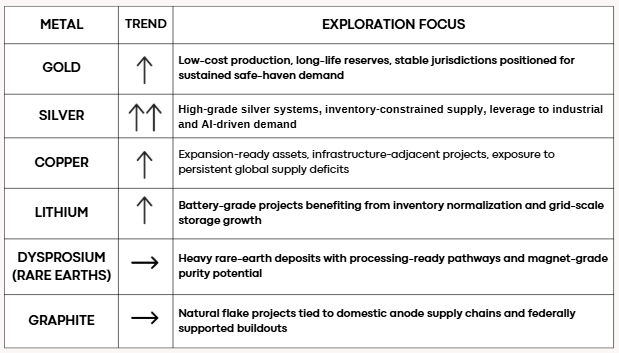

Gold: Gold pushed further into record territory as safe-haven flows stayed in control.

Central-bank buying and a softer dollar continue to anchor demand and keep downside limited.

Silver: Silver extended its breakout, outperforming again as supply tightness meets accelerating industrial demand.

The critical-mineral designation is now translating into real price pressure.

Copper: Copper drifted higher with the structural deficit narrative firmly intact.

The absence of new megamine supply continues to cap downside and support the market’s upward bias.

Lithium: Lithium prices added to the rebound as inventory drawdowns persist and grid-scale storage demand absorbs excess supply faster than expected.

Dysprosium: Prices held flat on the day, but the strategic picture continues to improve.

Domestic processing milestones are shifting supply-chain leverage away from offshore monopolies.

Graphite: Spot pricing was unchanged, while the strategic backdrop remains supportive.

Federal financing and downstream integration continue to strengthen the domestic anode thesis.

Metal Trend Exploration Focus

The Closing Lens:

You are navigating a market where "business as usual" has been replaced by strategic alliances and record-breaking drill results.

Whether it is the U.S. government securing its own supply chain or miners hitting high-grade gold far beyond their previous limits, the momentum is clearly shifting toward a more secure and lucrative future.