The days of viewing mining as a slow-moving relic are officially over as the sector transforms into a playground for AI and robotics.

You are currently witnessing a massive pivot where tech-driven efficiency meets a desperate global need for domestic critical minerals.

THREE KEY DEVELOPMENTS

This Gold-Silver Find Just Extended The Clock

The mining world is officially hitting its "glow up" phase, and 2026 is looking like the year the industry stops talking about the future and actually starts living in it.

If you’ve been watching the sector, you know that the old "pickaxe and shovel" image is dead.

Today, it’s all about autonomous fleets and AI-driven drills that analyze millions of data points while you sleep.

A massive shift is underway as these smart systems go mainstream, removing high-risk human roles and skyrocketing productivity.

Here is the real kicker: the U.S. is sitting on a goldmine of critical minerals but has lacked the processing muscle to finish the job.

That is changing fast.

With a major push for domestic refining and modernized permitting, the reliance on overseas competitors is finally being challenged.

You are looking at a redefined workforce where data analysts and robotics engineers are the new stars of the show.

Clean-tech mining isn't just a PR buzzword anymore; it is the baseline for securing public trust and staying competitive.

It is a high-stakes race, and the winners will be those who embrace this digital-first, sustainable era.

Your takeaway: Modernized U.S. processing and autonomous tech are turning mining into a high-tech powerhouse you can't ignore.

A Quiet Discovery Just Added Years To The Runway

If you’ve been waiting for Coeur Mining (CDE) to turn its exploration potential into cold, hard results, your patience just paid off.

The company just dropped results from its most ambitious drilling program since 2012, and the numbers are doing more than just moving the needle... they’re reshaping the entire bull case for the Palmarejo complex.

You are looking at a game-changer with the new Camuchín discovery in East Palmarejo.

For years, this 300 km² land package was largely a question mark, but now it’s a verified treasure chest of high-grade mineralization.

Beyond Camuchín, drilling has extended several major vein systems like Hidalgo and Independencia Sur, effectively stretching the mine’s lifespan before your eyes.

What makes this particularly sweet is that much of this new growth sits outside existing gold streaming obligations.

This means that as production scales, more of that precious metal value flows directly to the bottom line rather than being diverted.

The stock’s recent 5.8% jump is just the market starting to wake up to this expanded upside.

Your takeaway: With analysts now projecting revenues to hit $2.1 billion by 2028, Coeur is building a massive, sustainable production engine.

Massive new discoveries and strike extensions at Palmarejo are rapidly de-risking Coeur’s growth profile and locking in a much longer, more profitable production runway.

You’re Watching Robots Replace Clipboards And Guesswork

If you have ever felt like mine maintenance is just a never-ending cycle of "patch and pray," you aren't alone.

For decades, the industry treated infrastructure health as a massive, manual headache. But as aging assets meet tighter margins, the old playbook is officially being tossed.

You are now seeing a shift toward a high-tech reality where robotics and AI don’t just find problems... they prevent them before they even start.

You are looking at a future where "Joe on a rope" is replaced by wall-climbing robots that capture millions of data points in a single day.

These machines can identify sub-millimeter defects that a human with a clipboard would miss every time.

This isn't just a safety win; it is a massive win for your capital efficiency.

Companies like Gecko Robotics are proving that when you have a high-fidelity "health map" of your assets, you can stop replacing equipment early and start extending its life by decades.

By pinpointing the root cause of failures, you can optimize CAPEX and avoid those catastrophic, production-halting surprises.

The result is a smarter, leaner operation that tracks value from day one. In this new era, data-driven maintenance is the hidden lever for long-term profitability.

Your takeaway: High-speed robotic inspections and AI-powered health maps are turning maintenance from a cost center into a strategic advantage for infrastructure longevity.

TODAY’S TRIVIA

Poll: You see “Only 3 left in stock.” Your reaction?

MINING STOCKS TO CHECK OUT

This Critical Mineral Play Has National Importance

If you’ve been hunting for a stock that balances precious metal shine with "mission-critical" status, Americas Gold and Silver (NYSE: USAS) is making a loud case for your attention.

While many are just chasing the gold rally, you should be looking at the Galena Complex in Idaho.

This isn't just another silver mine; it is currently the only producing antimony mine in the United States.

In a world obsessed with domestic supply chains, being the sole provider of a critical mineral used in everything from defense to high-tech batteries is a massive competitive moat.

This optimism is backed by serious operational momentum, including a nearly twofold increase in quarterly silver production.

Institutions are also piling in, with a surge in fund ownership signaling that the "smart money" is betting on this North American expansion.

Between the high-grade silver growth at their Mexican operations and the strategic monopoly on U.S. antimony, USAS is repositioning itself as a diversified powerhouse.

This is a company that is no longer just digging for treasure; it is securing a vital piece of national infrastructure.

This Boardroom Makeover Means Business

If you have been waiting for Compass Minerals (NYSE: CMP) to get its house in order, the latest news from the boardroom suggests that the wait is over.

The company is leaning into a "back-to-basics" strategy, and they just loaded their board with heavy hitters who actually know how to run salt and potash businesses.

You are getting a front-row seat to a serious professional makeover. By adding veterans who have led global giants like Morton Salt and Newmont, Compass is signaling that it is done with distractions.

They even launched a new Capital Allocation and Technical Committee to ensure your capital goes exactly where it generates the most value.

Even their largest shareholders are applauding this move, stepping aside to let this high-powered group steer the ship.

For you, this means a leaner, more focused company that is prioritizing operational efficiency and a stronger balance sheet.

It is a refreshing pivot toward long-term stability and growth in essential minerals.

Mission-Critical Momentum: This Stock Became Too Important To Ignore

If you are looking for a stock that has quietly become indispensable to the high-tech world, Materion (NYSE: MTRN) is making a very loud case. While others chase the latest software hype, you should be watching the "material mastery" happening here.

Materion provides the advanced engineered materials that make space telescopes, defense systems, and semiconductor chips possible.

This isn't just basic mining; it is a high-stakes play on the global technology supply chain.

You are seeing serious institutional players back this narrative with real capital. Squarepoint Ops recently skyrocketed its position by over seven hundred percent, joining a wave of hedge funds and managers who now own nearly ninety-four percent of the company.

Why the rush? The answer lies in the fact that Materion is delivering record-high margins in electronic materials and seeing double-digit order growth in space and defense.

By acquiring key assets in South Korea and expanding its reach in Asia, the company is positioning itself perfectly for a massive 2026.

Even with shares trading near all-time highs, the combination of a dominant market position and aggressive margin expansion suggests this "mission-critical" leader still has plenty of runway.

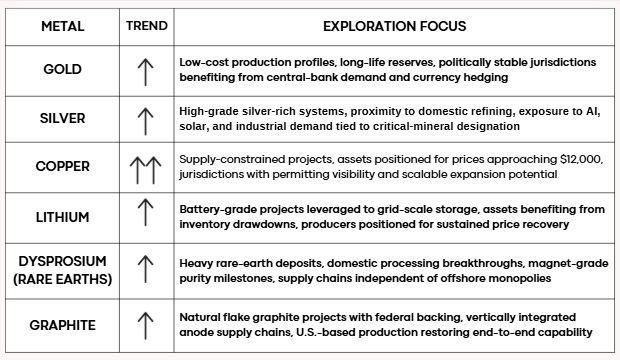

METALS SNAPSHOT

Gold: You are watching the yellow metal hit record territory as aggressive central bank buying and a softening dollar create the ultimate safe-haven rally.

Silver: Now that it has officially secured its U.S. Critical Mineral designation, you are seeing silver outpace the broader market thanks to a massive AI-driven industrial squeeze.

Copper: You should keep a close eye on the $12,000 mark as structural supply deficits and a total lack of new "megamines" push global prices toward a definitive breaking point.

Lithium: The long-awaited market rebound is officially here, and seeing prices jump over 25% year-to-date as grid-scale storage demand finally drains the global inventory glut.

Dysprosium (Rare Earths): A major domestic processing breakthrough as purity milestones finally break the offshore monopoly on the heavy rare earths used in high-performance magnets.

Graphite: A massive $2.1 billion federal loan for Graphite One is putting you in the front row for a domestic battery-anode revolution that restores end-to-end natural flake production for the first time in decades.

You are standing at the edge of a new era where the most profitable mines look more like Silicon Valley labs than dusty excavation sites.

As these companies swap old-school maintenance for robotic precision and domestic monopolies, you have a unique chance to ride a wave of industrial modernization that is only just beginning.